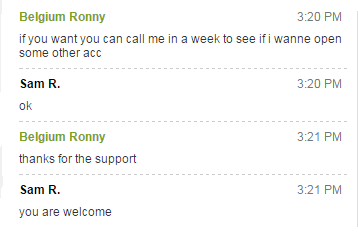

Daily Market Review - 02/11

- Donald Herison

- Hits: 1732

1. U.S. stocks were marginally higher on Monday as investors assessed factory activity data from China and Germany, and ahead of U.S. manufacturing data.

China's official factory data on Sunday showed activity unexpectedly shrank for a third straight month in October, though the contraction was modest.

2. The euro rose to session highs against the dollar on Monday, extending gains further above the 1.10 level after data showing the U.S. manufacturing sector expanded at the slowest rate in two years in October.

The dollar weakened after the Institute of Supply Management said its manufacturing purchasing managers’ index ticked down to 50.1 in October from 50.2 in September.

Economists had expected the index to decline to 50.0, which is the cut-off point between expansion and contraction.

3. Gold and silver prices fell to four-week lows on Monday, as investors continued to cut holdings of the precious metals on expectations of tighter U.S. monetary policy in the coming months.

Gold for December delivery on the Comex division of the New York Mercantile Exchange shed $8.10, or 0.71%, to trade at $1,133.30 a troy ounce during U.S. morning hours. It earlier fell to $1,132.50, the lowest since October 5.

4. Oil prices fell on Monday as weak Chinese economic data fueled concerns about demand slowing there and record-high production in Russia exacerbated the global supply glut.

Brent crude futures (LCOc1), the global benchmark, traded down 50 cents at $49.06 a barrel at 1428 GMT (09:28 a.m. EDT), down 1.1 percent. U.S. futures were trading at $45.98 a barrel, down 60 cents or 1.3 percent on Friday's close.

5. The pace of growth in the U.S. manufacturing sector slowed in October, remaining at its lowest level since May 2013, according to an industry report released on Monday.

The Institute for Supply Management (ISM) said its index of National factory activity fell to 50.1, its fourth straight monthly decline, from 50.2 the month before. The reading was just above of expectations of 50.0, according to a Reuters poll of economists.

6. Manufacturing activity in the U.S. expanded at the slowest rate in more than two years in October, dampening optimism over the strength of the economy and fanning hopes the Federal Reserve could delay raising interest rates until next year, industry data showed on Monday.

In a report, the Institute for Supply Management said its index of purchasing managers fell to 50.1 last month from a reading of 50.2 in September. Analysts had expected the manufacturing PMI to dip to 50.0 in October.

7. Manufacturing activity in the U.K. expanded at the fastest rate since June 2014 in October, boosting optimism over the country’s economic outlook and supporting the case for higher interest rates, industry data showed on Monday.

In a report, market research group Markit said that its U.K. manufacturing PMI rose to a seasonally adjusted 55.5 last month from a reading of 51.8 in September. Analysts had expected the index to decline to 51.3 in October.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()